The dockworkers’ strike that kicked off Tuesday has put U.S. ports in a chokehold, but if you think the oil and gas industry is going to be safe from the fallout, think again. While the Department of Energy (DOE) rushed to assure everyone that crude oil, natural gas, and other fuel imports and exports won’t be affected right away, experts are saying otherwise. Sure, the DOE insists the strike won’t have an immediate impact on fuel supplies or prices, but that’s like saying the Titanic didn’t sink until it hit the iceberg.

Adam Ferrari, CEO of Phoenix Capital Group, was quick to push back, noting that while the oil and gas industry might be holding steady for now, the broader economic blow from the strike is going to ripple through all sectors. “There’s no question this is a domino effect,” Ferrari said, warning that the longer the strike drags on, the more likely we are to see real disruptions in shipments, shortages, and—you guessed it—spiking gas prices. The labor that handles the loading and unloading of these critical resources could see significant delays, which is the last thing we need in an already shaky economy.

But it’s not just about gasoline prices and supply chain disruptions. Ferrari pointed out that if prices at the pump start climbing, investor confidence could take a nosedive, and we all know what happens when Wall Street gets jittery: more uncertainty, more volatility, and possibly more government intervention. And let’s be honest, we’ve already got enough tension between the oil and gas industry and the current administration as it is.

Phil Flynn, an energy market analyst, echoed these concerns in his daily report. He argues that while oil tankers and LNG ships are technically unaffected since the strike is targeting container ships, the bigger issue is demand. If containers stop moving, factories shut down, and guess what? They stop using oil. Fewer factories running means less oil burned, and if that doesn’t scream recession risk, I don’t know what does.

Meanwhile, the American Trucking Association President and CEO Chris Spear is sounding the alarm for the trucking industry, which could be next in line to feel the pinch. Truckers rely on those ports to keep goods moving across the country, and a slowdown at the docks means a slowdown on the roads. That’s bad news for everyone, especially consumers already grappling with inflation.

The union behind this, the International Longshoremen’s Association (ILA), representing 45,000 workers, is digging in for the long haul. Negotiations have gone nowhere, with wages, compensation, and protection from port automation at the heart of the dispute. And while several industries are begging President Biden to step in under the Taft-Hartley Act, the president has already made it clear he’s staying out of it. “I don’t believe in Taft-Hartley,” he said, letting the strike play out—for now.

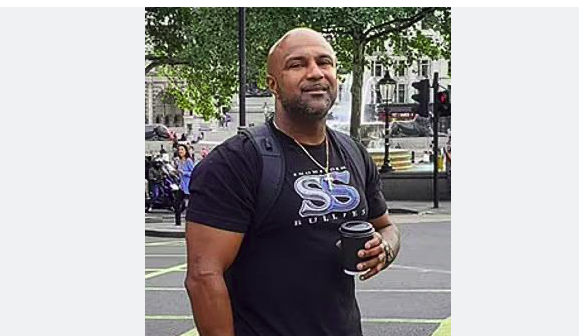

Head of the Longshoremen’s Association, 78 yr old Harold Daggert, brags about “crippling the U.S.” with his strike.

He makes $900k a year, owns a 76’ yacht, and drives a Bentley. pic.twitter.com/04hcJaOFRc— 🇺🇸ProudArmyBrat (@leslibless) October 1, 2024

If this strike continues, the U.S. economy could be looking at a daily hit of up to $4.5 billion, according to JPMorgan. Even the more conservative estimates, like Anderson Economic Group’s $2.1 billion weekly cost, paint a grim picture. But at the end of the day, whether or not the Biden administration decides to intervene could determine just how deep the damage goes.

Longshoremen pres. boasts about a strike hurting everyday Americans: “People never gave a shit about us until now, when they finally realize that the chain is being broke now. Cars won’t come in, food won’t come in, clothing won’t come in.” pic.twitter.com/rHJf1e96YU

— Tom Elliott (@tomselliott) October 1, 2024

So, while the DOE might be shrugging off concerns of an oil and gas crisis, this strike is shaping up to be more than just a speed bump—it’s a ticking time bomb for industries across the board.